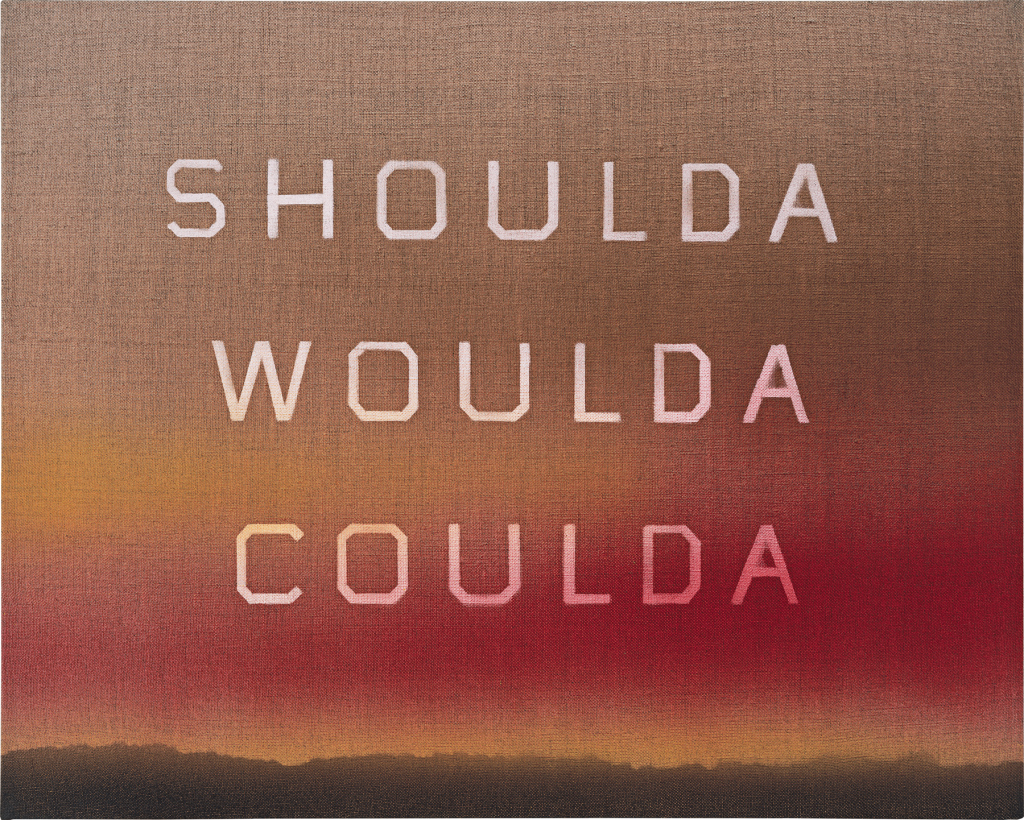

In the fast-paced world of trading, it’s common for traders to experience moments of regret or feel like they missed out on opportunities. This mindset, often referred to as the “woulda coulda shoulda” syndrome, can hinder progress and prevent traders from reaching their full potential. However, by adopting a different perspective and implementing some practical strategies, traders can overcome this mindset and focus on future success. In this post, we will explore valuable advice to help traders break free from the “woulda coulda shoulda” mindset and move forward with confidence.

1.- Embrace the Learning Experience:

Trading, like any other endeavor, involves a learning curve. Instead of dwelling on past trades and missed opportunities, view them as valuable learning experiences. Reflect on what went wrong, identify the lessons learned, and use that knowledge to make better-informed decisions in the future. Remember, successful traders continuously evolve and grow through their experiences.

2.- Cultivate a Growth Mindset:

Adopting a growth mindset is essential for overcoming the “woulda coulda shoulda” syndrome. Embrace the belief that skills and expertise can be developed through effort, learning, and persistence. Understand that setbacks are stepping stones to progress and that with each trade, you have the opportunity to improve and refine your trading strategies.

3.- Practice Self-Reflection:

Regular self-reflection is crucial for understanding your trading patterns and tendencies. Analyze your decision-making process, emotional reactions, and biases. This self-awareness can help you identify areas for improvement and develop a more disciplined and strategic approach to trading. Keep a trading journal to record your thoughts, emotions, and lessons learned after each trade.

4.- Set Realistic Goals:

Setting realistic goals is a vital aspect of successful trading. Define clear and achievable objectives that align with your trading style, risk tolerance, and financial aspirations. By having a roadmap, you can focus on the present moment and make decisions based on your predetermined goals, rather than dwelling on missed opportunities.

5.- Implement Risk Management Strategies:

One major source of regret in trading comes from poor risk management. Establishing effective risk management strategies, such as setting stop-loss orders and position sizing, can help you limit potential losses and protect your trading capital. By prioritizing risk management, you can minimize the impact of any missed opportunities and maintain a disciplined approach to trading.

6.- Seek Mentorship and Support:

Having a mentor or joining a trading community can provide valuable guidance and support. Engage with experienced traders who have overcome similar challenges and learn from their insights. Surrounding yourself with like-minded individuals who understand the trading journey can help you gain perspective, share experiences, and stay motivated.

Overcoming the “woulda coulda shoulda” mindset in trading requires a shift in perspective and the implementation of practical strategies. By embracing the learning experience, cultivating a growth mindset, practicing self-reflection, setting realistic goals, implementing risk management strategies, and seeking mentorship, traders can break free from the chains of regret and move forward with confidence. Remember, trading is a journey filled with ups and downs, and it’s through embracing these experiences that traders can grow and ultimately achieve success. So, let go of the past, focus on the present, and trade with a mindset of continuous improvement.